Now is the time.Īll of the estimates above are speculation based on the past history of AT&T Inc. The dividend from $1K invested is 4.97 times more than yesterday’s single share price. So, by my dogcatcher ideal, this is good time to buy T shares based on their dividends for the year 2022. The Indian market is maintaining its resilience despite mixed cues from global equities and surging oil prices.

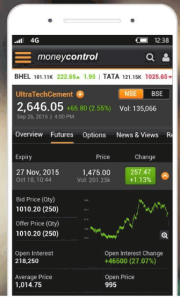

Of course, a single share of T stock at today's $14.94 price is almost one fifth of the annual dividend income from our $1000.00 investment. Prices start as low as Rs 2.5 per day In the broader market, the S&P BSE MidCap index rose 282.90 points (1.13 per cent) to end at 25,424.08 while the S&P BSE SmallCap climbed 373.14 points (1.30 per cent) to settle at 29,096.16. In a year our $1K investment in shares of AT&T Inc could generate $74.30 in cash dividends. Subtract that maybe $0.15 brokerage cost from my estimated $5.06 gross gain per share results in a net gain of $4.91 X 67 shares = $328.97 for a 32.8% net gain including a 7.43% annual yield. My upside increase estimate of $5.06 is $1.43 under the average price upside forecast from 24 analysts tracking the stock for brokerage houses.ĪT&T’s most recently declared quarterly dividend of $0.2775 per share makes an annual dividend of $1.11 and casts a yield of 7.43%.Īdding the $1.11 annual AT&T dividend to my one-year price upside estimate of $5.06 shows a $6.17 potential gross gain per share.Īt today’s $14.94 closing price, a little under $1000 would buy 67 shares.Ī $10 broker fee (if charged), paid half at purchase and half at sale, might cost us $0.15 per share. If AT&T’s stock trades in the range of $12.00 to $24.00 this next year, its recent $14.94 share price might reach $20.00 by next year. T’s share price fell by $5.26 or about 26% in the past year. Those three basic keys best tell whether any company has made, is making, and will make money.ĪT&T’s price per share was $14.94 at Friday’s market close. NSE/ BSE Listed companies stock price quotes list, top company stock list on Moneycontrol. was incorporated in 1983 and is headquartered in Dallas, Texas. Get all Indian company stock quotes listed in the share market. This RSS feeds allow you to stay up to date with the latest. This is an RSS feed from the Bombay Stock Exchange website.

Bombay Stock Exchange Stock Forecast BSE Share Price Predictions with Smart Prognosis Chart - 2022-2023 You can find here the Best Indian Stocks to buy Showing 1-100 of 3,373 items.

#Moneycontrol stocks full#

RSS feed is a XML file that provides summaries, including links to the full versions of the content.It is available through RSS feed reader or through some browsers. Search Stock, FX pair, Crypto, or Commodity. The company was formerly known as SBC Communications Inc. RSS stands for Really Simple Syndication. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements. Residential fixed-line services, about 10% of revenue, primarily consist of broadband internet access service.ĪT&T also has a sizable presence in Mexico, serving 21 million customers, but this business only accounts for 2% of revenue. BusinessLine Indias leading website for business and financial news, BSE and NSE quotes, stock recommendations, market analysis and research, politics. wireless carrier, connecting 68 million postpaid and 17 million prepaid phone customers.įixed-line enterprise services, which account for about 20% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Wireless business contributes about two thirds of AT&T’s revenue following the spinoff of WarnerMedia. I have discussed T previously and I most recently selected it as my 3rd pick for Viital, my seventh, portfolio. It is the first of five communication services candidates vying for the second slot in my Viking folio. When the MACD crosses below the signal line, it gives a bearish signal, indicating that the price of the security may see a downward movement and vice versa.AT&T Inc, ticker T, is a large-cap telecom services company in the communication services business sector. A nine-day exponential moving average, called the signal line, is plotted on topof the MACD to reflect "buy" or "sell" opportunities. It is the difference between the 26-day and 12-day exponential moving averages. The MACD is known for signalling trend reversals in traded securities or indices. The MACD signalled a bullish bias on the counter. Net profit after tax for the latest quarter stood at Rs 4421.0 crore, up 4.66 per cent from the same quarter a year ago. The company reported consolidated sales of Rs 39355.0 crore for the quarter ended 3, down 2.67 per cent from previous quarter's Rs 40433.0 crore and down 35.0 per cent from the year-ago quarter's Rs 29151.0 crore. Promoters held 0.0 per cent stake in the company as of 3, while FIIs held 8.68 per cent and domestic institutional investors had 2.1 per cent.

0 kommentar(er)

0 kommentar(er)